By Maxim Elramsisy | California Black Media

This profile is part of a series of 10 California Black Media articles capturing the stories of elected Black Mayors working to make a difference in the lives of Californians in large cities and small towns across our state.

When the City of Fontana hosted NASCAR Feb. 24, third-term Mayor Acquanetta Warren served as an honorary official for the final run of the Cup Series Pala Casino 400.

According to Warren, Auto Club Speedway, formerly California Speedway, will undergo reconstruction that will reduce its size from the current two-mile track to a half-mile one.

One observation stood out for Warren as the mayor reflected on the final race on the racetrack that opened in 1996 in the city about fifty miles east of Los Angeles.

“I’m seeing way more African Americans working on the cars. They are more among the vendors, and I think in two more years, we’ll have even more,” she said.

“I’m constantly trying to get younger sisters and brothers that look like me to understand that you can have these dreams and they can be fulfilled,” Warren told California Black Media (CBM). “Don’t limit yourself.”

Although stock car auto racing has a well-known lack of racial diversity, particularly among owners and drivers, former NBA great Michael Jordan bought a majority stake in NASCAR’s 23XI team in 2020. Driving the team’s “23 car,” a nod to Jordan’s Chicago Bulls jersey number, is Bubba Wallace, NASCAR’s only active Black racer.

Other racing teams are becoming more diverse, too. Lamar Neal, a 29-year-old Black man, was on the pit crew for Kyle Busch’s race-winning team.

“It’s a sport that’s waiting for young smart people, not just drivers or pit crew, but the analytical side, the engineers — a whole world waiting for young, good people,” said Warren.

As the race cars revved up their engines to the thundering roars of the race spectators, Warren said she was reminded that inflation continues to skyrocket and that natural gas prices are running higher than normal — a point many guests attending the series also pointed out.

“We recognize these are really hard times, especially with the gas costs. People are calling me with bills [totaling] $600 to $800 when they’ve been paying $52 a month. That is terrible,” Warren told CBM.

Leaders must respond urgently to the high costs, Warren said.

Enter Fontana Eats, a program distributing gift cards for food to residents of the city.

“We had already been working on this program, but I want to increase [the amount people in the program receive]. It is also an opportunity for us to get our residents out more and do it safely,” she said. “They can go to restaurants, or they can go to grocery stores.”

When Warren was elected mayor in 2010, she was an experienced local politician, having served eight years on the city council.

Like many places around the world, the COVID-19 pandemic presented new challenges.

“We probably had over a half a million free masks to give out,” Warren said, recalling a step the city took responding to price gouging by some businesses.

Measure EE, in San Bernardino County, narrowly passed in November 2022. It directed elected representatives for San Bernardino County to research and advocate for all methods (including secession from the state) for receiving an equitable share of state funding and resources.

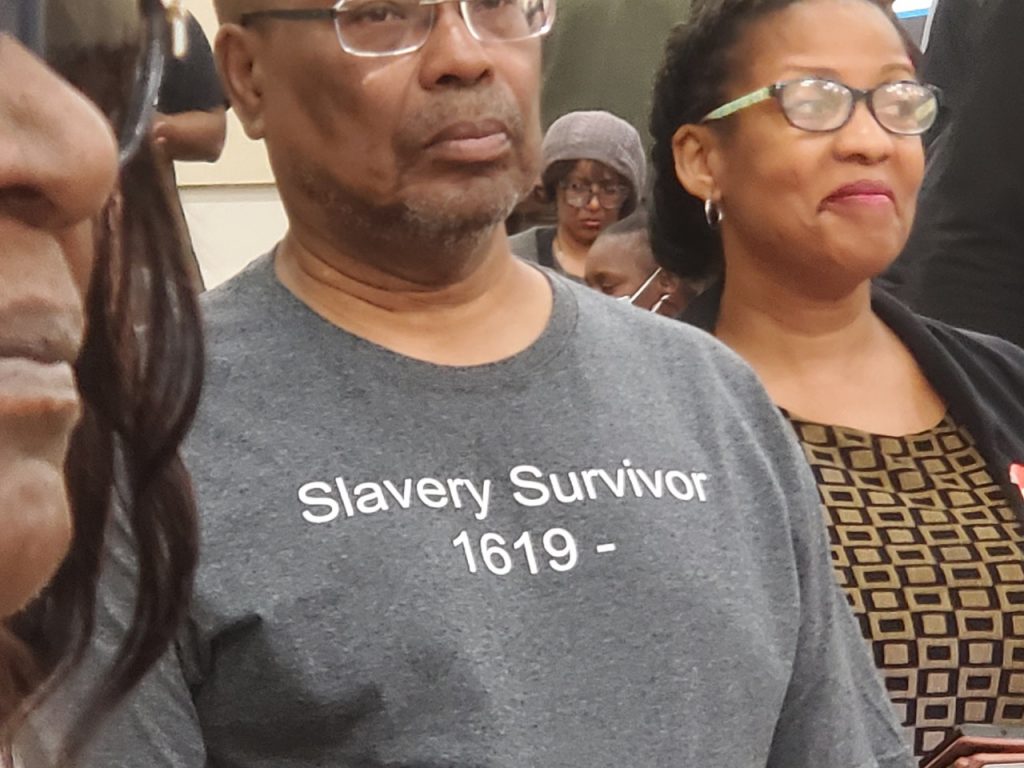

Mayor Acquanetta Warren greets JROTC volunteers at Auto Club Speedway in Fontana, California on February 26, 2023. (Maxim Elramsisy | California Black Media)

“I really advocated for people to vote for [Proposition] EE, because it’s a study on whether or not we’re obtaining the funds fairly in this county. We always are the stepchildren,” said Warren. “San Bernardino County is the largest county in the United States by land mass. Yet, we can’t really make it work if we’re not getting adequate funding.”

For example, Warren says her city does not have enough courthouses and judges.

“People talk about fairness, equity and due process. Well, it would help if we could get them into court and get them out of jail. If you don’t have the resources, everybody has to wait,” she said.

In addition to advocating for funding and tackling food insecurity, Warren is pushing for more public parks.

“We’ve always focused on our recreation, particularly for our young people. We don’t want them to be graduates of sidewalk university,” she said. “We’ve got softball, we’ve got baseball, football, soccer, basketball. We have various programs that the kids can sign up for. They can do arts, they can dance.”

According to Warren, the city now has 59 parks to keep its 220,000 residents active.

As she walked across the front straight away, Warren spoke with anyone who approached her, and she stopped by to a room full of teenagers from the Boys and Girls Club of Fontana.

Warren says she moved to Fontana after the Rodney King riots in 1992 shook her neighborhood in Compton.

“When I got appointed to be the first African American on the council, people were making a really big deal, but I discounted it,” she said. “For many residents though, it was a big deal. The Black pastors and a lot of the older African Americans in this community called me to a meeting and they let me have it. They let me know that I stood on their shoulders, and they were proud of me.”

Warren is an advocate for more diversity among people addressing the challenges all Californians face. This month she was named the Chair of the Southern California Water Coalition’s Board of Trustees.

“We need more African Americans in the water world. All these people are retiring,” she said.

Although several heavy storms have hammered California over the past three months, including a historic storm disrupting the weekend race schedule, Warren doesn’t think California’s historic drought is over.

“The challenge will be, can we capture the water when it melts, and store it, and that’s where we fall short,” she said.

Drivers resume the race at the final NASCAR race on Auto Club Speedway’s 2 mile configuration in Fontana, California on February 26, 2023. (Maxim Elramsisy | California Black Media)

Westside Story Newspaper – Online The News of The Empire – Sharing the Quest for Excellence

Westside Story Newspaper – Online The News of The Empire – Sharing the Quest for Excellence