By Tanu Henry | California Black Media

The Hon. Margaret Richards-Bowers, 70, a retired registered nurse, community advocate, and former President of the Inglewood Unified School District (IUSD) Board of Education, passed away on Jan.16, 2024, following a prolonged illness.

Born on April 15, 1953, in Saint Vincent and the Grenadines, an island nation in the eastern Caribbean, Margaret Mundus Richards was the eldest of seven children born to Vernon Richards and Enid Banfield Richards.

Richards-Bowers graduated from the prestigious St. Vincent Girls’ High School, where she served as class prefect in her senior year, a role held in high regard and viewed as second only to a teacher in terms of authority and respect. She was the first runner-up in the Miss St. Vincent Teenager contest, and she had the honor of having tea with the late Queen Elizabeth II of England.

In 1972, Richards-Bowers moved to Los Angeles. She worked part-time while studying for an Associate of Arts Degree in Nursing at East Los Angeles College. She later earned a Bachelor of Science degree in Health Service Management from the University of La Verne in Los Angeles County. Although she had interests in acting and singing, she chose a career in nursing for its stability. However, notably, she played a crucial role in the formation of the Pan African Film & Arts Festival, according to Ayuko Babu, the festival’s Executive Director.

“Margaret’s unique perspective, stemming from her Caribbean roots in St. Vincent, and her Los Angeles experiences enriched the festival’s Pan African outlook. Her contributions were pivotal to the festival’s development and will always be cherished,” Babu said.

After becoming a Registered Nurse, Richards-Bowers began her career as Nurse Manager at Pico Psychiatric Medical Clinic. She later joined Daniel Freeman Memorial Hospital in Inglewood, where she served in various roles, including Staff Registered Nurse in the Oncology Unit and Charge Nurse in the Coronary Care Unit. In 1990, she joined Kaiser Permanente, West Los Angeles, serving as a Staff Registered Nurse and Relief Charge Nurse in the Urgent Care Clinic.

While at Kaiser, Richards-Bowers served as the Chairperson of the Employee Congress Committee. She authored the committee’s mission statement and initiated “The Culture of Courtesy” program that promoted an environment of courtesy and respect. In 1998, Richards-Bowers left Kaiser to focus on raising her sons.

Richards-Bowers was deeply involved in volunteer activities. She served as a member of the Los Angeles County Community Emergency Response Team (CERT), the Sheriff’s Community Advisory Committee and as a volunteer deputy at the Ladera Heights Sheriff Community Service Center. She was a director and Vice-President of the Ladera Heights Civil Association in unincorporated LA County, and was a member of the Tuskegee Airmen, Inc., and the National Council of Negro Women.

Richards-Bowers was a community health advocate and Board member of the Citizens Coalition for a Safe Community. She testified before the LA County Planning Commission on the Inglewood Oil Field Community Standards District. She also advocated for environmental considerations and community involvement in a school construction project before the IUSD School Board.

Richards-Bowers, who became a U.S. Citizen in 1996, was deeply involved in political activism even before she could vote. She helped elect local and national candidates that shared her values, like Mervyn Dymally, a fellow Caribbean immigrant, to Congress. Eventually, she became a deputy registrar of voters.

Richards-Bowers participated in several campaigns for former LA Police Chief and City Councilman Bernard Parks who admired her dedication, saying, “Margaret channeled her unwavering political passion into tangible actions. Her journey from grassroots campaigning to becoming a national delegate is a testament to her relentless advocacy. Her legacy will continue to inspire us.”

Furthermore, Richards-Bowers was a member of the New Frontier and Culver City Democratic Clubs, the National Women’s Political Caucus’ South Bay Chapter, and Organizing for America. In 2008, she served in various roles for the Obama for America Campaign, including Precinct Captain, and Volunteer and Resource Coordinator for the 33rd Congressional District. She was elected as a District Delegate for the 2008 Democratic National Convention held in Denver. She had the unique privilege of engaging in conversations with Presidents Clinton and Obama.

Richards-Bowers was a passionate advocate for public education. She held leadership roles, including Co-President of the Frank D. Parent School PTA, and was a member of the IUSD Budget Advisory Committee and Measure GG Bond Committee, which secured $90 million for school facility improvements. She co-founded the Education Equity Coalition when IUSD went into state receivership and advocated for an audit of district management, appearing before the State Legislature twice until the audit was approved.

Richards-Bowers also sought to effect change through elected office. Although her first attempt to join the IUSD School Board was unsuccessful, she persevered and won a seat, eventually serving as President of the Board. Unfortunately, health issues prevented her from running for re-election.

According to current IUSD Board President, Dr. Carliss McGhee, “Margaret Richards-Bowers was my soulmate on the Inglewood school board. Her tireless dedication, love for students, and her spirit and tenacity for progress in education reflect her genuine commitment to ensuring a brighter future for the students she served. Her absence will be felt, and she will be sorely missed.”

Richards-Bowers was not only a dedicated professional and community advocate, but also a published poet, runner, music enthusiast, and an art aficionado.

Richards-Bowers leaves behind a loving family. She is survived by her husband of 37 years, Joe William Bowers Jr., eldest son Shawki Haffar Jr., son Jason Takao Bowers and his wife Roslyn, and cherished grandchildren, Wolfgang and Sachiko. She is also survived by sisters Merlyn, Bernadette, and Jacqueline, and brothers Robert, Leon, Bernard, and Claudon.

The funeral for Richards-Bowers is scheduled for Feb. 5 at the Holy Cross Mortuary, located at 5835 West Slauson Ave, Culver City, CA 90230. The viewing will start at 10:30 AM, followed by services from 12:30 PM to 1:30 PM.

Westside Story Newspaper – Online The News of The Empire – Sharing the Quest for Excellence

Westside Story Newspaper – Online The News of The Empire – Sharing the Quest for Excellence

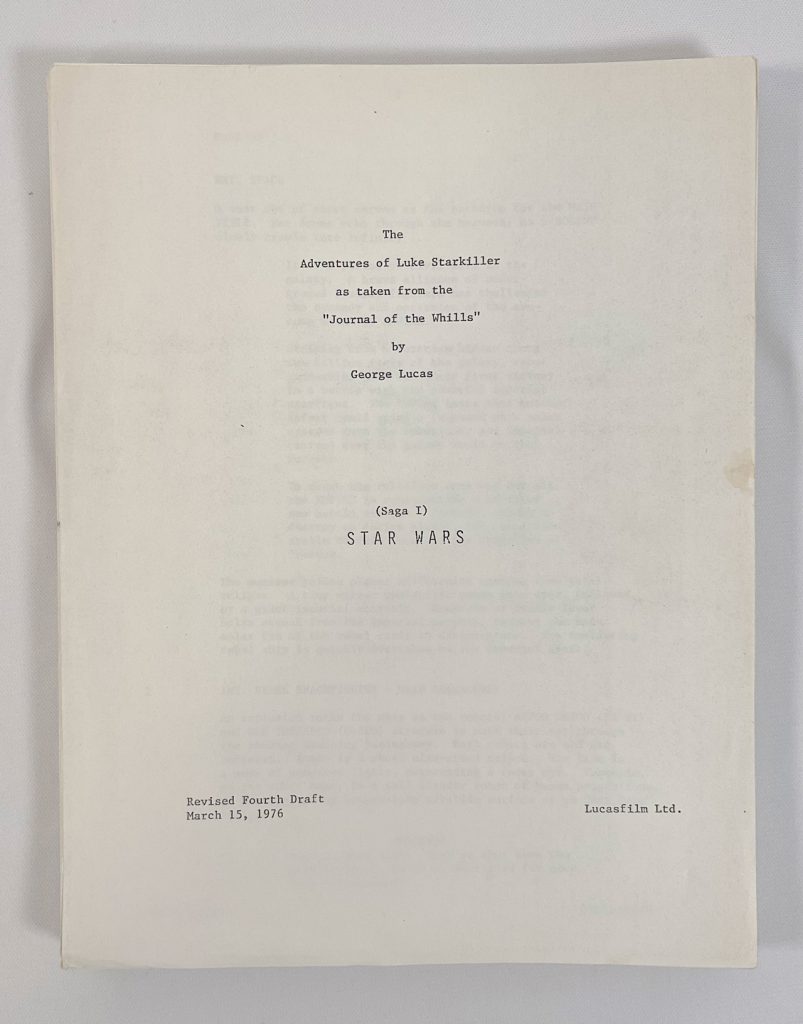

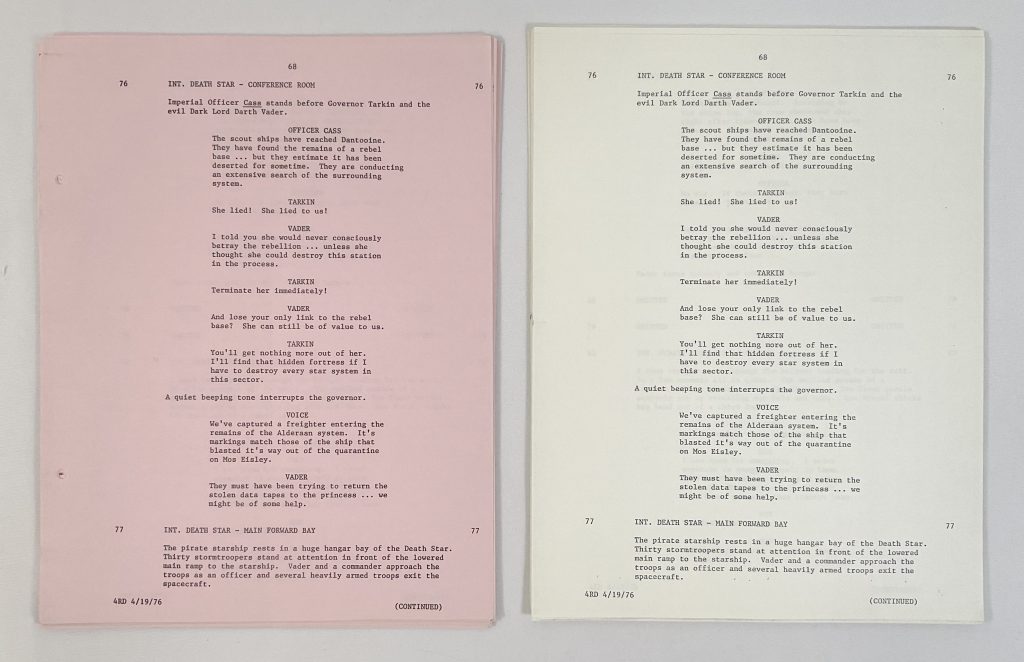

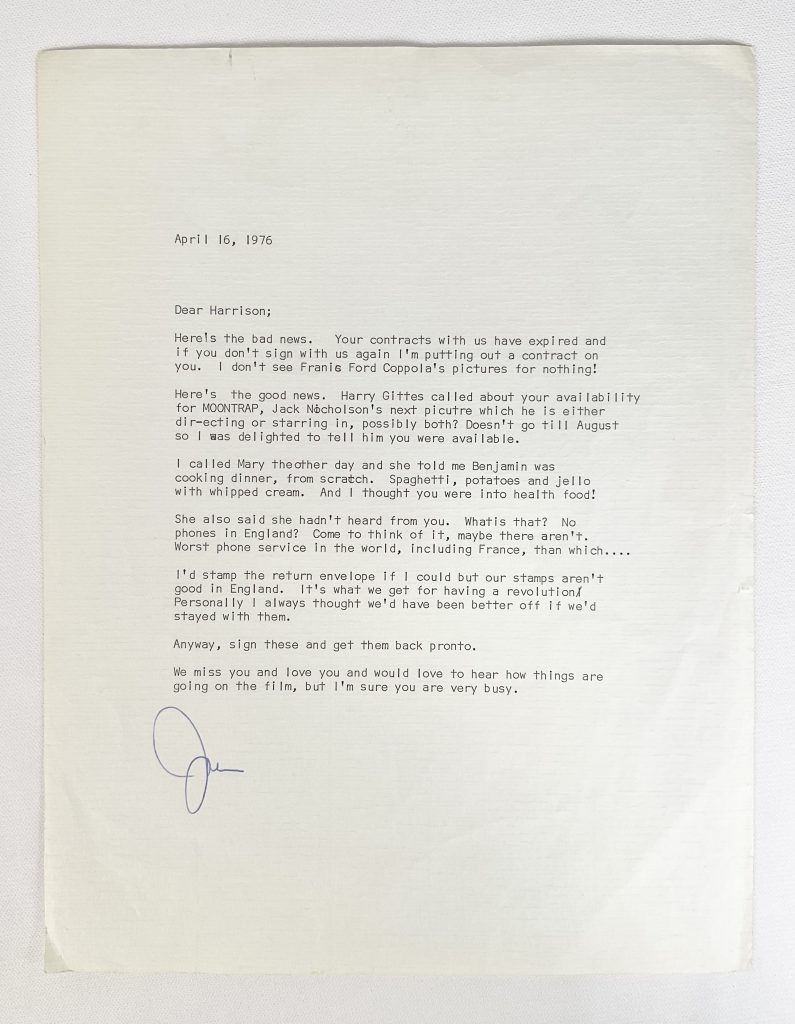

In the letter, McQueeney playfully scolds Ford for not calling his first wife Mary Marquadt, whom the actor was married to between 1964 and 1979. Auctioneers estimate that this could fetch between £60 and £80.

In the letter, McQueeney playfully scolds Ford for not calling his first wife Mary Marquadt, whom the actor was married to between 1964 and 1979. Auctioneers estimate that this could fetch between £60 and £80.