By Antonio? ?Ray? ?Harvey? |? ?California? ?Black? ?Media?

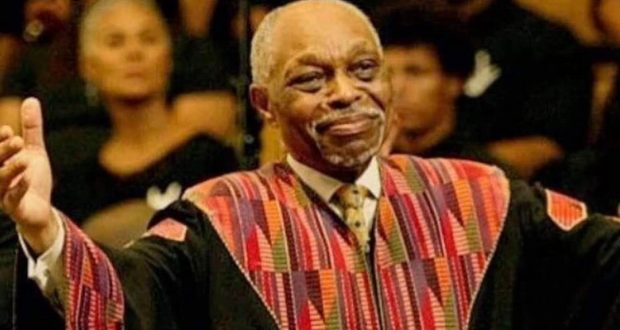

On January 11, the California Legislative Black Caucus (CLBC) honored the legacy of Dr. Martin Luther King, Jr, at a breakfast celebration held at the Grand Ballroom of the Town and Country Event Center in downtown Sacramento.

The annual CLBC event was attended by about 200 people, including members of the Legislature from diverse backgrounds, community leaders, staffers from the State Capitol, among other attendees.

“It was an honor to host this year’s annual Martin Luther King, Jr. Day breakfast. The California Legislative Black Caucus put on another lively event with great discussion on ways we can honor Dr. King’s legacy and uplift all Californians,” CLBC Chair, Assemblymember Lori A. Wilson (D-Suisun City), posted Jan. 11 on the social media platform X.

At the breakfast, Assemblymember Reggie Jones-Sawyer (D-Los Angeles), a member of the CLBC, served as the master of ceremonies at the breakfast held four days prior to the date that would have marked King’s 95th birthday on Jan. 15.

CLBC members Assemblymember Chris Holden (D-Pasadena) provided the invocation and Assemblymember Kevin McCarty (D-Sacramento) led the Pledge of Allegiance. Sen. Steven Bradford (D-Inglewood), Vice Chair of the CLBC, shared a message from members of the Black Caucus.

Bradford revealed a little unknown fact about Dr. King’s name. He was born Michael King, Jr., on Jan. 15, 1929. In 1934, his father, a pastor, traveled to Germany where he was inspired by Protestant Reformation leader Martin Luther, Bradford said.

“As a result, King, Sr. changed his own name as well as that of his 5-year-old son,” Bradford shared.

To the delight of the audience at the event, sponsored by Vertex Pharmaceuticals, vocalist Nia Moore-Weathers performed a powerful rendition of the Black National Anthem, “Lift Every Voice and Sing,” a hymn written as poem by National Association for the Advancement of Color People (NAACP) leader James Weldon Johnson in 1900.

Wilson held a 30-minute fireside chat with guest speaker Kwame Anku about Dr. King’s life, achievements, and vision, and the importance of building wealth in Black families and communities.

Anku is the founding managing partner and chief investment officer of Black Star Fund, an early-stage venture capital fund. He got the idea to start the fund on the urging of Roger “Prince” Nelson, the singer, songwriter, multi-music instrumentalist who passed away in 2016.

Anku was named the 2022 Entrepreneur of the Year by Sacramento Metropolitan Chamber of Commerce and was also among 21 distinguished recipients of the prestigious Aspen Ascent Fellowship awarded by the Aspen Institute. He said King’s famous 1963 address at the Lincoln Memorial in Washington, D.C., the “I Have a Dream speech,” could have been more aptly titled “America, It’s Time to Look in the Mirror” reflecting its core messages of accountability and denied justice.

“We’re telling ourselves how great we are but we’re not living up to the promise that we’ve made to ourselves because that’s the bedrock of what we do when he said we have come here today to cash the check,” Anku told Wilson. “So, we’ve come to cash the check because this check guarantees us the riches of freedom and the security of justice. So now we’re not just cashing that check. Now, we are writing those checks.”

This year marks the 57th Anniversary of the CLBC. For nearly six decades, the CLBC has been a key advocate for issues such as fair housing and the prevention of homelessness.

Historically, the coalition of Black lawmakers has actively resisted redlining in banking and insurance in California, and fought against apartheid in South Africa, among other issues.

The CLBC plans to continue the legacy of Dr. King by developing legislation around its current priorities, which include pursuing reparations for eligible Black Californians, criminal justice reform, environmental justice, and helping to ensure greater access to education and enterprise for African Americans. During the 2024 legislative session, the CLBC aspires to secure funding for critical programs and organizations working to enhance the lives of Black Californians.

There are 12 members of the CLBC serving in the California Assembly and Senate.

Westside Story Newspaper – Online The News of The Empire – Sharing the Quest for Excellence

Westside Story Newspaper – Online The News of The Empire – Sharing the Quest for Excellence

A portrait of Lord Byron. SWNS.

A portrait of Lord Byron. SWNS.

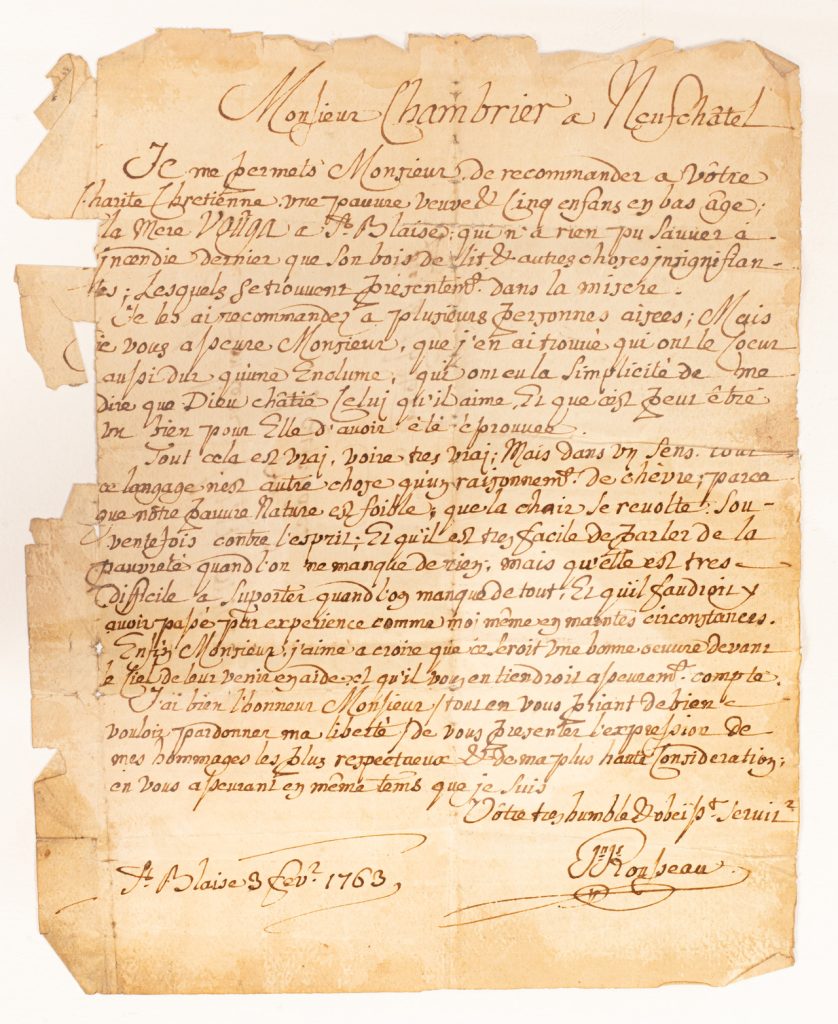

The letter from Jean Jacques Rousseau. CHORLEY’S VIA SWNS.

The letter from Jean Jacques Rousseau. CHORLEY’S VIA SWNS.